A voucher is a means by which one is obligated to accept it as payment for the delivery of goods or services. Goods, services, or the identity of the providers are indicated on the voucher itself or in the corresponding documents. This voucher is exempt from value-added tax.

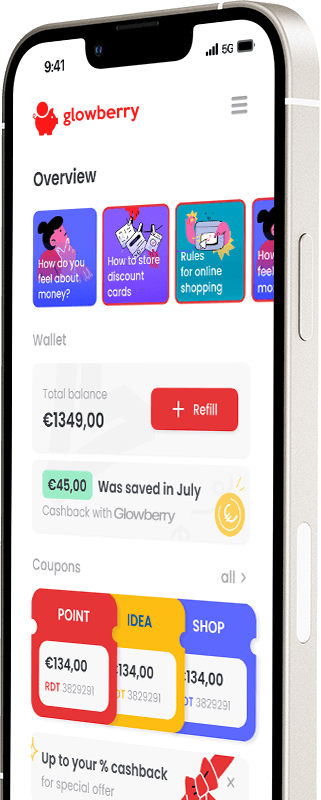

The Glowberry platform is a SaaS solution for payment solutions that allows any business to issue its own vouchers, for which customers receive goods or services and the seller receives funds in return. Commissions are determined through individualized merchant agreements, ensuring tailored financial arrangements with transparent, competitive pricing structures.

No concealed expenses. Flexible commission structures tailored to individual merchant requirements.

Integration and usage of the solution is simple - to get started with Glowberry, only registration on the platform is required. Our technical specialists will assist you with all necessary integrations. All you need is a smartphone or tablet. Vouchers are accepted either through the app or via a QR code that you show to the customer on your smartphone.

Glowberry vouchers are environmentally friendly compared to paper or plastic vouchers. They do not get lost, do not get damaged, and do not require expenses for production, distribution, and administration.

To start operating with Glowberry coupons you only need to register with the platform. Our tech-specialists will help integrate online-payments.

Companies and entrepreneurs can be Merchants. Individuals, companies and entrepreneurs can be Customers.

Customers can purchase coupons online on the Glowberry Merchant’s page. Transactions are processed through our secure digital ecosystem, compliant with both UK and EU regulations including UK Payment Services Regulations and Strong Customer Authentication (SCA) requirements.

The voucher, also known as a coupon, is defined in UK VAT legislation following the UK’s implementation of EU Council Directive 2006/112/EC and its relevant amendments, as well as in the EU Council Directive itself for EU customers. According to these definitions, a voucher is an instrument that must be accepted as full or partial remuneration for the supply of goods or services. The goods or services to be supplied, or the identity of the specific providers, must be specified either on the instrument itself or in the accompanying documents, including the terms of use. For UK customers, these regulations are implemented through the Value Added Tax (Vouchers) Order 2018 (SI 2018/1188) and related UK VAT legislation.

Fill this form and our onboarding team will contact you ASAP.

🍪 This website uses cookies to enhance your browsing experience.